Vehicles such as vans are assets that will be used to produce money for the business over time. Debit Cost of Office Equipment 15000 Debit GST Input.

Integrated Supply Network Isn Linkedin

A and company ABC have made the hire purchase agreement of the car.

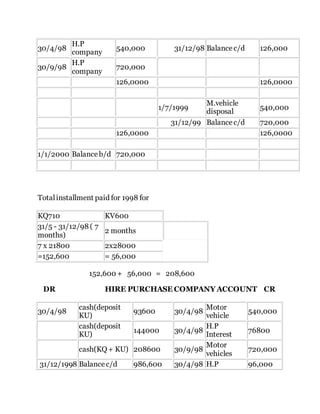

. Provision construction or purchase of plant and machinery used for the purpose of a business other than assets that have an expected life span of less than two 2 years. A For buying assets on hire purchase. Lease accounting operating vs financing leases examples.

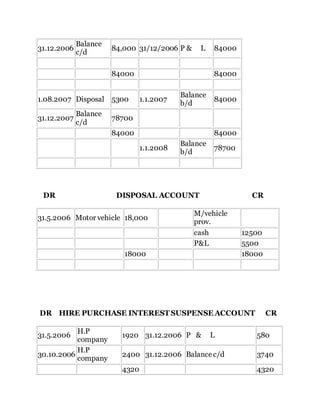

Dr Trade Creditors finance. Use the Purchase Invoice transaction to record the bill received from the. Dr disposal of motor vehicle account When the customer agrees to buy an asset under a hire purchase contract heshe is required to complete the hire purchase application form which indicates all.

Disposal Value If an asset is disposed. And im not sure on how to capture the entry. Journal Entries in the books of Purchaser.

The interest rate per annum is 5. Hire purchase HP or leasing is a type of asset finance that allows firms or individuals to possess and control an asset during an agreed term while paying rent or instalments covering depreciation of the asset and interest to cover capital cost. Application of the Law On the disposal of a plant or machinery in the basis period for a year of.

The interest rate per annum is 388 flat. This article demonstrates how you can record a hire purchase transaction of an asset with monthly instalment. A credit facilities are provided by the seller or the credit.

Assuming you purchase a new Office Equipment at 20000 and financed it with a Hire Purchase plan. - cost of assets used in a business such as plant and machinery office equipment furniture and fittings motor vehicles etc. The car costs 10000 and it requires to pay 30 initial payment and the remaining balance will be paid monthly with interest expense.

The monthly payment over 3 years is equal to 200. در واقع است 511-517 Jalan Pasir Puteh Taman Camay 31650. Approx 001 KM away.

Fixed asset trade in double entry bookkeeping. Initial payment 10000 30 3000. Qualifying expenditure QE QE includes.

You have put down a deposit down payment of RM7500000 which means the financed amount is RM10000000. During the financial year the previous accountant had done only the following entries each month with regards the HP contract. Ipoh Perak Malaysia 511-517 Jalan Pasir Puteh Ipoh 31650 Malaysia.

Credit Hire Purchase 19200. Purchased from Maruti Udyog Ltd. 1050 Debit Interest in Suspense.

There are four methods of accounting for hire purchase. But this is not all. 63900 x 35 month.

The purpose of this entry is to transfer the cost of the fixed asset to the asset disposal account. You record the motor vehicle in your accounting as a 15000 asset. I supply cars to car dealers.

For example the company purchase a car of RM70000. There are two columns in each account with debit entries on the left and credit entries on the right. He pay 20000 for down payment.

When I am purchased. Therefore the remaining 50000 is paid using hire purchase facilities for 6 years. The accounting entries would be as follows.

When purchasing a motor vehicle often we made a down payment deposit and arrange the balances with a car loan. I am preparing the accounts for a client using his previous accountants bookkeeping. Assets are defined as anything of monetary value that is owned by a firm or an.

Double entry accounting is a record keeping system under which every transaction is recorded in at least two accounts. The double entry will be. Can help me to have a check for the double entry that I write for the following.

3940274 After clearing off HP Creditor interest Disposal Consideration Amount. In this case the net book value cost less accumulated depreciation of the fixed assets increases by 24000 which is the new vehicle 30000 less the net book value of the old vehicle 17000 11000 6000. Total Interest charge base on 5 interest.

Hire Purchase double entry. 300000 100000 3 years. Assuming you purchase a motor vehicle at S8000000 S8560000 with GST and you paid S1000000 as a down payment and take a loan for the remaining amount.

A motor van on 1st April 2009 the cash price being Rs 164000. There is no limit on the number of accounts that may be used in a transaction but the minimum is two accounts. Suami Istri Subur Tapi Tak Kunjung Hamil Ini Amalan Agar Cepat Dibe.

YA 2021 plant is defined to mean an apparatus used by a person for carrying on his business but does not include a building an intangible asset or any asset used and functions as a place. He has a HP agreement on which he pays installments of 210 per month. Mun Choong Pasir Putih - See 29 traveler reviews 66 candid photos and great deals for Ipoh Malaysia at Tripadvisor.

I got the figure and hopefully you can help me. Delhi Tourist Service Ltd. The double entry of the Enter Bill transaction.

Mimpi hamil oleh mantan pacar VIVA Kasus penggorokan. For this transaction the Accounting equation is shown in the following table. The purchase was on hire purchase basis Rs 50000 being paid on the signing of the contract and thereafter Rs 50000 being paid annually on 31st March for three years Interest was charged at 15 per annum.

According to the Regulations the term credit sale means the sale of goods where. Under existing rules lessees account for lease transactions either as off-balance sheet operating or as on-balance sheet finance leases. Under cash price method we are deal hire purchase transactions just like normal transactions.

Hire purchase remaining value. If the cash price was 7000 plus 1225 of VAT which was reclaimed as input tax the double entry is. In addition the asset of cash in reduced by 25000.

For motor vehicle the person whose name is on the vehicle card. The most common credit sale in Malaysia involves the purchase of home appliances furniture and electrical items with seller or credit facility provider such as Courts Singer and AEON. 62 Beneficial ownership Beneficial owner is the person who has actually incurred the QE and payment for the asset that can be proved in the books of accounts with supporting.

Representatives Frank Pallone Jr. You are acquiring a motor vehicle that costs RM17500000 with a 5-year hire purchase plan. Here it is my company disposed a car by transferring ownership to individual with no cash consideration.

For machinery the person whose name is on the warranty certificate or insurance policy. Address 511 517 Jln Pasir Putih 31650 Ipoh. The accounting rules require us to.

You create both the Interest in Suspense and Hire Purchase account as a Long-Term Liability since the payment term is more than a year. When transactions or event happen we record them. It enables companies to finance property plant and equipment without the need to incur large initial cash outflows.

3 Fundamental Question For Accountant In Malaysia

Automotive Direct Mail Postcards

Buying A Car For Your Business 11 Tips For A Good Small Business Investment

Bayfield Ford Lincoln Linkedin

Pin By Yogendra Skt On Sk Job Search Websites Accounting Jobs Job

7 Passenger Suv Rental Airport Van Rental

Sample Vehicle Quotation Template Quote Template Quotations Quotation Format

Some Thais In Thailand Claim Vietnam Shouldn T Make Its Own Car Brand Because Only Japan From Asian Countries Can Compete In The Global Car Market What Is Your Opinion About This Claim

Importing Cars To The U S Clearit Usa

How Big A Threat Is An Apple Car To Tesla Quora